Explore Digital Banking Platform

Start to explore Digital Banking Platform for customer service. Download mobile app, make payments through ATM’s emulator or check our Internet banking service. As if you were a client. You can find the technical working aspects of the platform in the description section of back-office applications.

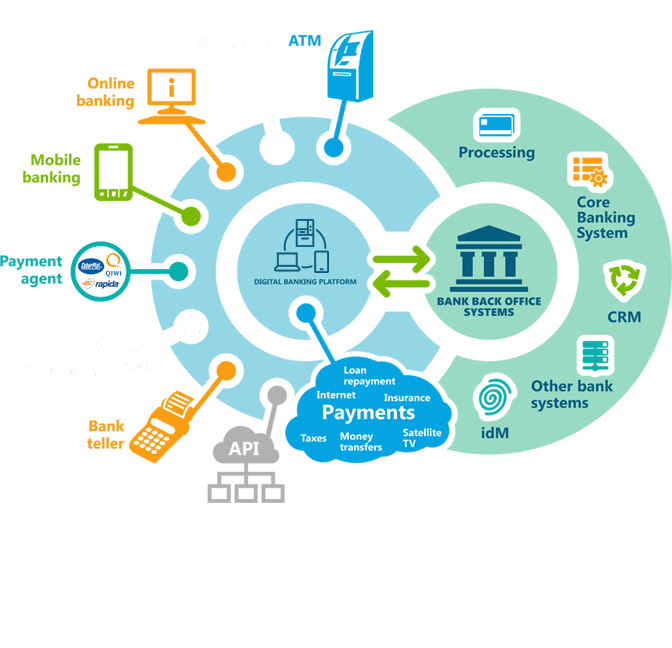

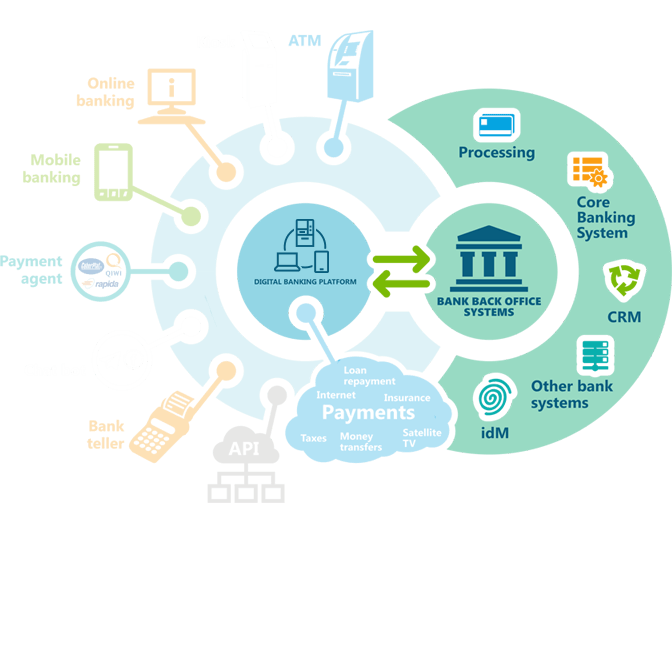

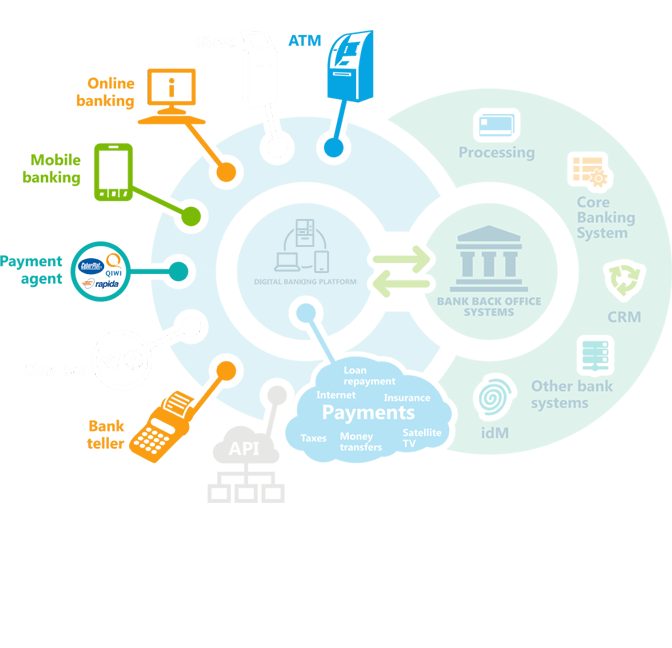

Channels

Deliver outstanding service through omnichannel integration across mobile apps, ATMs, kiosks, Internet banking. Just follow the instruction to test each solution.

Back office

Manage all service points from one place. Set routing for payments, show different content on different equipment, organize cooperation with agents at the solutions of Digital Banking Platform for back office.

How to use?

Open the page with the solution that interest you

Download the application on your phone or follow the link in the demo application

To login to the application use credentials that you received during registration

Test the operation of applications, if necessary, contact our managers for consultation

How to get access to back-office?

To get more information and access to demos please fill the form.

Our manager will call you and send instructions with access to demo.